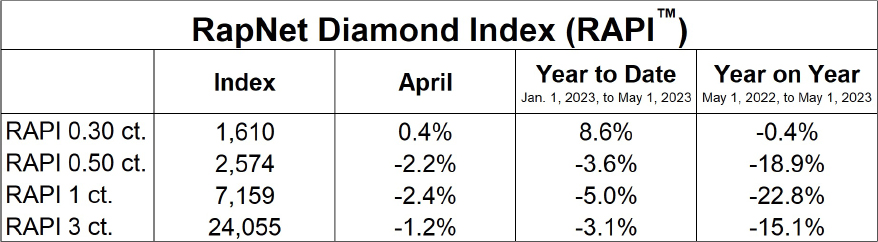

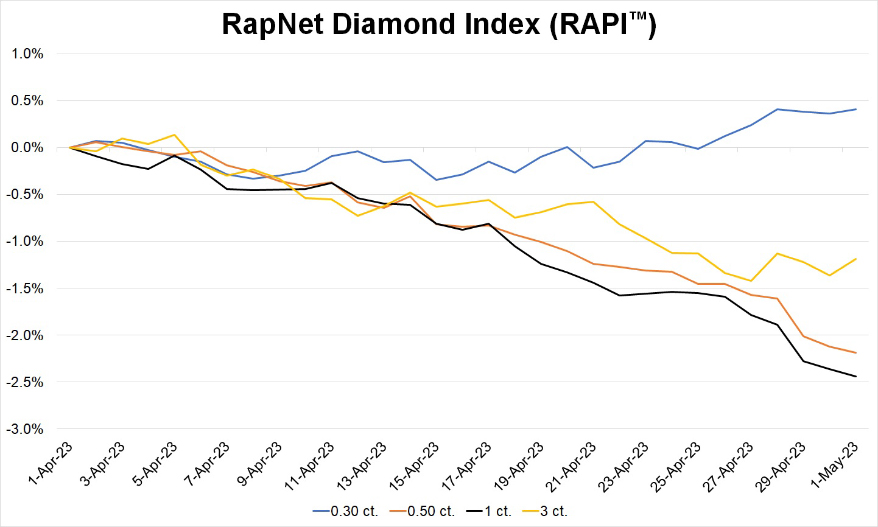

(PRESS RELEASE) LAS VEGAS, NV — The RapNet Diamond Index (RAPI) for 1-carat polished diamonds fell 2.4% in April. The index declined to 7,159 on May 1, versus 7,543 at the beginning of the year. Other sizes were also weak. RAPI for 0.30-carat diamonds saw some stability, while prices of smaller goods dropped, reversing their upward trend.

Diamond prices slipped due to sluggish demand in the US and China, the two largest markets for diamond jewelry.

“Polished trading was quieter than usual in April,” said Rapaport Senior Analyst Avi Krawitz. “Economic uncertainty stemming from the rise in consumer prices over the past year has impacted discretionary spending and discouraged retailers from buying inventory.”

© Copyright 2023 by Rapaport USA Inc.

US jewelers have reduced their bulk purchases, focusing on memo to avoid owning excess goods in an uncertain environment.

Chinese buyers are cautious amid economic prudence on the mainland. Hong Kong retail is improving, boosted by a revival in tourism, but a slowdown in trading reflects restraint among Chinese dealers.

Advertisement

Midstream polished inventory continues to rise even as manufacturing levels have dropped.

Polished production is well below capacity, with restrictions on Russian supply limiting the availability of rough. In India, the largest manufacturing center, first-quarter rough imports were down 22% year on year to $4.26 billion.

Still, rough prices declined on the secondary market, reflecting weak interest ahead of the De Beers sight beginning May 2.

Rough and polished trading is expected to remain cautious in May, with dealers hoping the upcoming Las Vegas shows will lift sentiment and boost demand for the second half.

“The diamond trade has endured a difficult start to 2023,” Krawitz added. “The Las Vegas shows will be a test of conditions and provide a gauge for the state of the important US market. For now, inventory is meeting demand, and there is no urgency to buy before jewelers start preparing for the end-of-year holidays.”

Advertisement