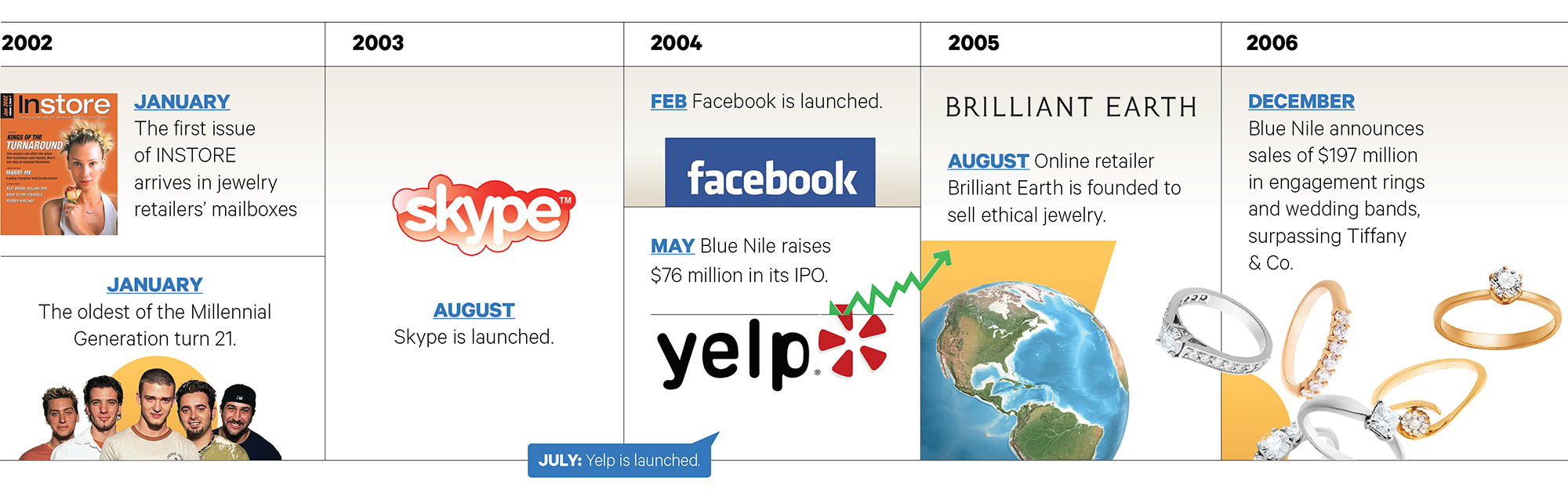

WHEN INSTORE LAUNCHED in January 2002, keystone was still the benchmark for retail diamond margins. A shift toward stand-alone superstores in high-traffic locations was all the rage. The only social networking sites were Classmates, Six Degrees and Ryze (remember those? Me neither). Socially speaking, the measure of an engagement ring was simple: How large was the diamond?

My, how things change.

Today, most retailers are happy to get a 40 percent margin on loose diamonds. But they do much better on custom designed mountings — which works out, because today’s jewelry customer (primarily millennials) almost always wants something unique. While the physical location of a store is still important, its website is generally more critical for building traffic. And a variety of social networking sites allow consumers to communicate with and compare notes on retailers more than ever before.

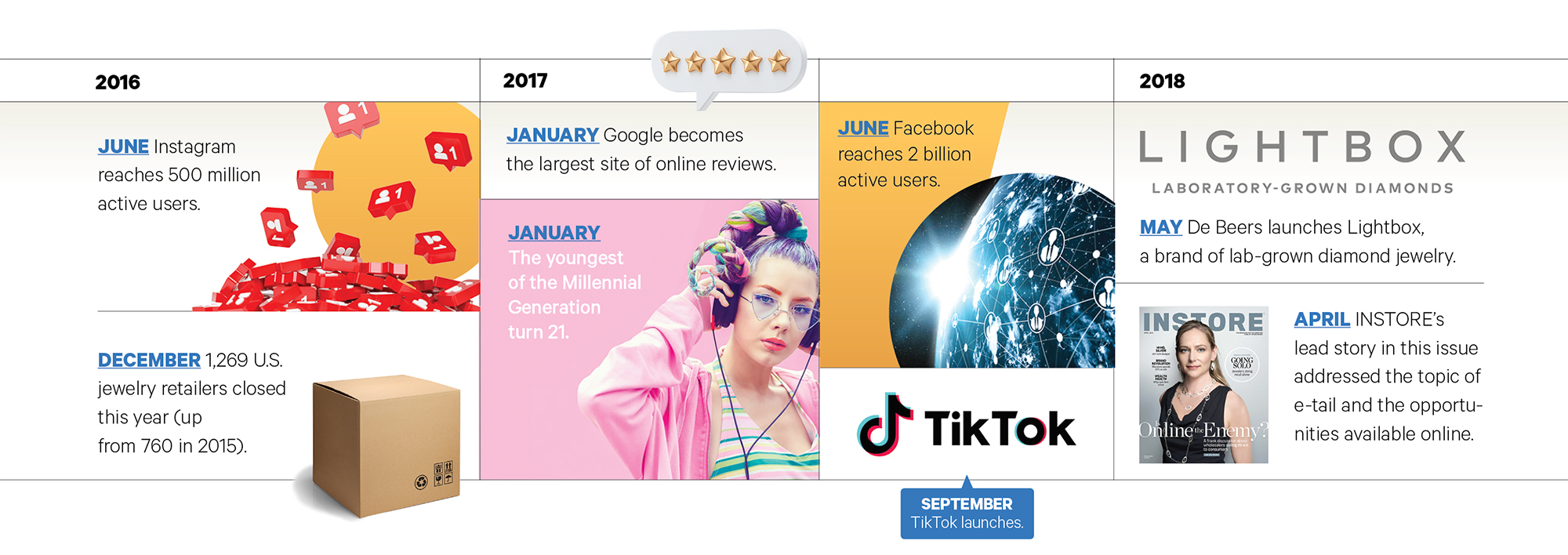

Not only that, but INSTORE shipped to about 50 percent more doors. We’ve lost close to 10,000 retail jewelry stores since the early 2000s.

As part of INSTORE’s 20th anniversary coverage, we’re looking back on the forces that have most affected jewelry retailing over the last two decades. In so doing, we hope to give you some insight into how we got here, as well as some thoughts about where we’re heading as an industry.

Advertisement

E-COMMERCE

When e-com giants like Blue Nile and James Allen began selling jewelry direct to consumers for lower prices than traditional brick-and-mortar retailers could afford to charge, many of our readers cried foul, and some worried that the future of the independent jewelry store was under threat.

But something strange happened. Blue Nile and James Allen began opening physical locations to capitalize on the brand power they had built (while simultaneously undermining their message that brick-and-mortar retailers could not compete). At about the same time, independent retailers were figuring out how to use their websites to sell jewelry, promote their stores and build traffic.

“I believe e-commerce is the biggest disruptive game-changer for the jewelry industry, and we haven’t even come close to seeing or feeling its full impact yet,” says Ben Smithee of The Smithee Group, a digital growth agency. “The media is appropriately priced, the data intelligence a small business has access to is incredible, and the always-on nature of e-commerce is completely scalable.”

Harold Dupuy, vice-president of strategic analysis for manufacturing group Stuller, agrees that e-commerce is the biggest disruptive force in the jewelry industry. “This sector’s growth is impressive (12-15 percent per year) over the past 15 years, the exception being the 2020 pandemic year where it grew at an increased rate of 25 percent,” says Dupuy. “The biggest problem with jewelers thinking about e-com is that many view it as ‘us versus them,’ when it’s a complementary channel and a consumer preference that enhances the holistic shopping experience if done properly.

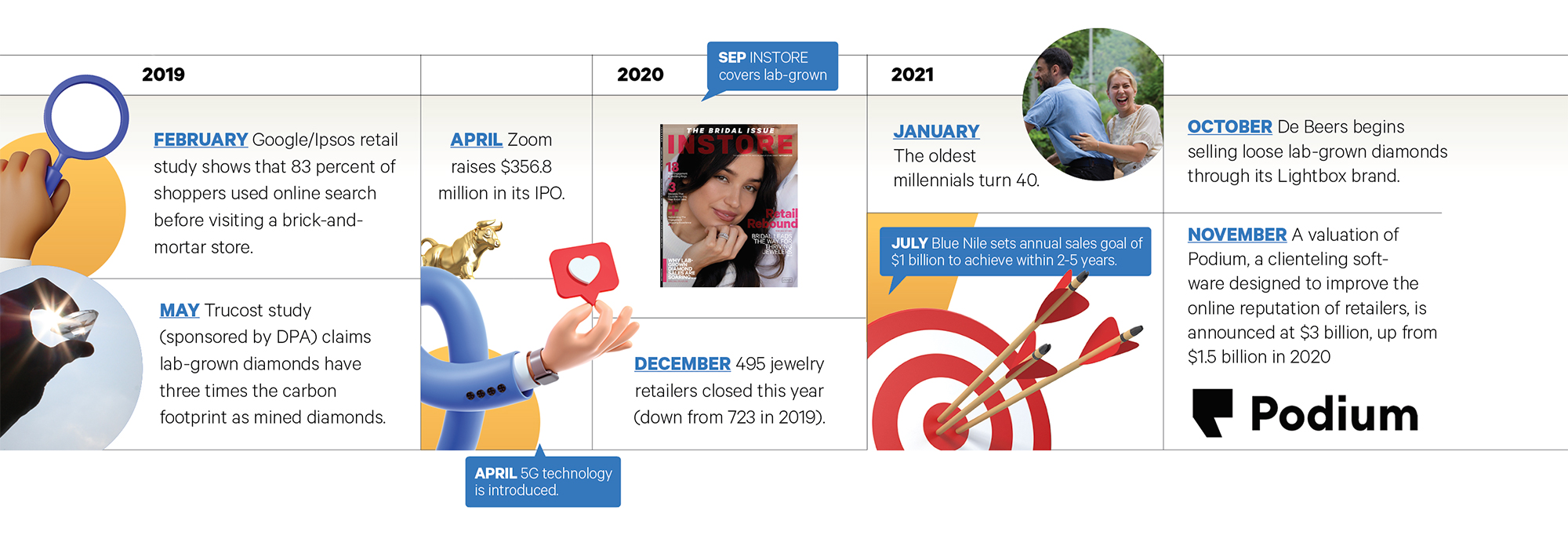

“Five years ago, e-com was predicted to wipe out brick-and-mortar, but consumers have spoken and want stores … to touch and feel product, pick up and return online orders, etc. The channels now play an important role in supporting each other.”

Consultant Kate Peterson of Performance Concepts compares e-commerce with earlier 20th century phenomena like catalog shopping and television sales networks like HSN and QVC — all of them made purchasing jewelry more convenient for consumers. The retailers who are thriving now, she says, are those who embraced online technology, even if they didn’t know what they were doing at first. “This is the group that has grown steadily over the past decade-plus, that never missed a day during any of the shutdowns, and that, by and large, did more business per store in 2020 than in any other year in their history.”

Custom jeweler Jim Tuttle, owner of Green Lake Jewelry Works, is one such retailer. “E-commerce lets us reach outside our local market, and although available to all jewelers, it is not used well by many and has allowed newer businesses to stand up and compete with the most venerable old names,” he says. “We compete against the Blue Niles, CustomMades and 10,000 ‘Instagram jewelers’ who often use a simpler e-commerce model and seem to hope to skim only the ‘easy cream’ off the top and frequently refuse to do the ‘hard work’ of being a true custom jeweler.”

E-commerce not only provides the consumer with more choice, but it also allows the retailer to expand their offerings without investing in more inventory, says Shane O’Neill, vice-president of Fruchtman Marketing. “For retailers without a physical store, the cost to scale up a business falls dramatically. People can build businesses out of their homes and grow into a brick-and-mortar versus the other way around,” he says.

“Many retailers see it as a pain to deal with a shopper who has found something online, but over the last decade, most have realized this is the norm,” says consultant Megan Crabtree. “We coach retailers not to run and get the G color SI2 diamond like the customer found online, but to educate the customer, build a relationship, and point out the benefits of shopping locally, such as lifetime service or upgrade policies.”

Additionally, the tools available to independent retailers online allow them to compete on an even playing field with the e-tail giants, says Alex Fetanat, founder and president of GemFind Digital Solutions. “With things like a streamlined checkout process, order tracking, in-store pickup options, online financing, online payment installment options, fraud prevention and more, jewelers who take full advantage of e-commerce solutions specifically created for jewelry stores are the ones seeing a significant increase in sales.”

MILLENNIAL

SHOPPERS

Just as INSTORE’s first issue was reaching jewelry store owners in 2002, the oldest of what was then called Generation Y (now usually referred to as “millennials”) turned 21 and began to make their presence felt in the engagement ring market. Born between 1981 and 1996, they are the first generation to have grown up totally immersed in a world of digital technology.

“I got my start in the jewelry industry because of so many businesses’ interest in the millennial consumer,” says Smithee. “They are what drove the impact of e-commerce and social media, and arguably many of the disruptive forces in the jewelry industry.”

Wrote one respondent to INSTORE’s 2020 Big Survey: “Millennials — you know the type. Oversensitive, phone-obsessed, selfie-snapping, ‘Friends’-binge-watching, kombucha-guzzling, influencer-obsessed complainers.”

Perhaps, but those who ignored the predilections of this enormous generation of consumers did so at their own peril.

“Since they could hold a phone, they have been going to the World Wide Web,” says consultant David Geller of JewelerProfit. “You need to be there constantly. You need to walk the walk and talk the talk, just like they do.”

Today, the most successful stores are the ones that have embraced millennial shoppers and seek to meet them where they are. “We have had great success connecting with this generation because we have people just like them behind the counter,” says Rhett Outten, co-owner of Croghan’s Jewel Box in Charleston, SC. “The biggest change is the use of technology. Millennials are website and Instagram shoppers who prefer a direct message, email or a text to a phone call or a face-to-face visit. We feel that we have adapted pretty well, but there is always more to learn.”

Matthew Rosenheim, president of Tiny Jewel Box in Washington, DC, believes that millennials are just another shopper that jewelry retailers have to adapt to. “Millennials have proven that certain things are very important to them: sustainability and ethical sourcing is one of them,” he says. “I’m not personally a retailer who bemoans how difficult it is to deal with millennial shoppers; I don’t feel that way. I think as they get older, they’ll start to look a little more like other generations of shoppers.”

Regardless of how they’ll look in the future, it always starts with listening to the customer, says Ronnie Malka of Malka Diamonds & Jewelry in Portland, OR. “Baby Boomers and Gen X were comfortable being placed in a box: You went into a store, you saw what you saw, and you bought it. It seems like millennials and Gen Z are focused on an experience and us creating something together, custom making it, and creating something unique,” says Malka. “It’s a cool way to do the work we do, because I’m not trying to sell something; they’re coming up with concepts along with me.”

Advertisement

LAB-GROWN

DIAMONDS

If there’s been a topic more asked about, discussed and dissected over the last five years, we don’t know what it is. “Lab-grown diamonds are clearly the most disruptive force, from a product perspective, that I’ve seen in over four decades in the industry,” says Harold Dupuy of Stuller.

Of course, lab-grown diamonds have existed for even longer than that four decades: since 1953, in fact, when a Swedish electric company called Allmana Svenska Elektriska Aktiebolaget created the first batch. Gem quality lab-grown diamonds became commercially available in the late 1980s. Why, then, did it take another 30 years for lab-grown diamonds to make waves for retail jewelers? Two reasons: cost and scalability.

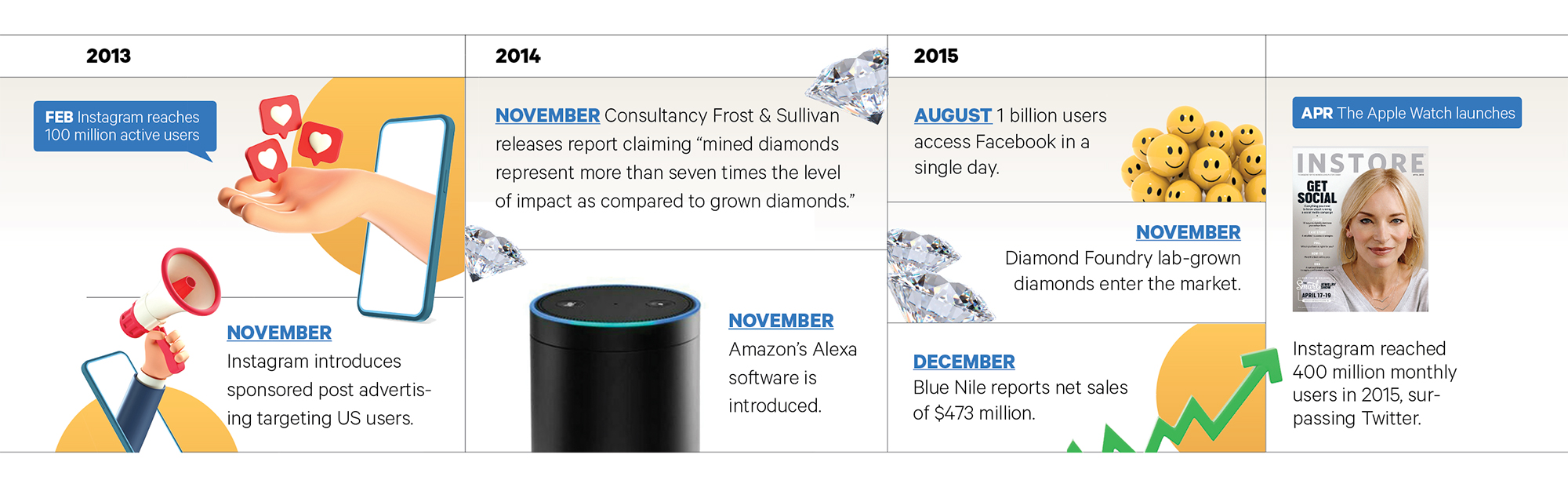

Lab-grown diamond growers like Diamond Foundry, founded in 2012, figured out how to make beautiful gem-quality diamonds more efficiently and on a larger scale. According to a report from the Antwerp World Diamond Centre, it cost $4,000 per carat to produce a CVD-grown diamond in 2008. By 2018, that cost was just $300-500.

Mined diamond producers reacted to these developments with alarm, sensing a threat to their business. Dupuy believes this was a mistake. “I think the opposing forces strategically erred by creating a ‘natural versus lab-grown’ adversarial relationship. It seems that after six years and large advertising expenses, the tone has shifted and now the natural segment is highlighting the benefits of its own product.”

Susanne Siegel, a Chicago-based jewelry designer/retailer, says that regardless of how jewelers feel about lab-grown diamonds, consumers are increasingly asking for them. “Ultimately, it’s an individual choice for designers and retailers to make, and one that many have changed their minds on as consumer demand continues,” she says.

Despite attempts by De Beers and other mined diamond producers to influence consumers to view lab-grown diamonds only as options for fashion jewelry, many shoppers are openly accepting lab-grown diamonds as center stones in their engagement rings. According to Dupuy, more than 40 percent of jewelry retailers now sell loose lab-grown diamonds.

“Based on Indian imports into the U.S. for the trailing 12 months June 2021, over $930 million of LGD came into the U.S. The average year-over-year imports growth since 2019 is an amazing 90 percent increase. Estimating importer and retailer markups, this translates to approximate $2.5 billion at retail value or close to a 15% market share of the U.S. diamond market,” says Dupuy.

With volume comes choice, says Crabtree Consulting VP Jackie Johnson. “Not only do you have hundreds of suppliers to source lab-grown through, but also, due to the technology advancements, you have more consistent goods and a larger range of qualities to choose from,” says Johnson. “The larger range in quality has allowed retailers to expand their offering of lab-grown diamonds and to offer up to three qualities, such as a good, better, and best option. These programs have been successful, allowing retailers to accommodate all consumer expectations.”

SOCIAL

MEDIA

Although it began as a way to connect with family and friends, social media is now one of the most crucial and cost-effective ways for businesses to market to their customers.

“From a retail perspective, referral has been and is the No. 1 driver of new business. Social media allows not only consumers to share products or experiences they love, but also for retailers to reach out to the consumers en masse,” says Shane O’Neill of Fruchtman Marketing.

John Carter of Jack Lewis Jewelers in Bloomington, IL, has been amazed by how quickly social media has displaced traditional media as the medium of choice for marketing, calling it not disruptive but “eruptive.” “If you really stop to think about what it has done, in less than 10 years, it has changed the way all companies around the globe attempt to reach the eyes and ears of the consumer. Other forms of media dominated the landscape for more than a hundred years, and nearly overnight (in the scheme of things), those have been displaced.”

But like any new technology, social media has changed rapidly over the last two decades, sometimes reversing course entirely in terms of how businesses can engage with their followers. “Over the past decade, it has evolved from a lot of visibility of organic posts and content to virtually zero visibility unless ads were being utilized to today where quality content is king and long-form video content avenues like Instagram Reels and TikTok are taking over,” says GemFind’s Alex Fetanat.

Another aspect that social media has changed is transparency, says Kate Peterson. “Social media has taken away every corner in which to hide ‘trade secrets.’ Platforms like Google, Facebook, Twitter, Yelp, Trip Advisor, NextDoor and others have made transparency an imperative, and have turned ‘stars’ into legitimate currency.”

Yet despite its challenges, social media has proven to be an affordable way for jewelry retailers to drive interest and engagement with their clients. “If we would have had to rely on traditional media in 2020, we would have seen a lot of businesses completely disappear,” says Smithee.

Smithee warns that upcoming advances in social media will be even more disruptive than what we’ve seen over the past two decades. “Similar to e-commerce, the world of social media is still in its infancy stages, and businesses are about to see another shocking round of disruption within social media with regard to data intelligence and paid advertising,” he says. “Data intelligence will separate the haves and have-nots in the industry.”

O’Neill agrees, citing Facebook’s metamorphosis into the company called Meta and its goal to create a “metaverse” that spans the physical and virtual worlds. “Facebook — or I should say Meta — is spending billions of dollars on the next evolution of social media, called the Metaverse, and while many will dismiss it with a chuckle, it’s very real and will make the next 10 years 100 times more disruptive than the past 10.”

UNIQUE AND

CUSTOMIZED

JEWELRY

Is the movement toward unique and customized jewelry a natural evolution of consumer preference? Does it have to do with fundamental differences between millennials and previous generations? Or is it due to advances in technology that allow the custom process to be completed both more quickly and more affordably?

Regardless, it’s the single biggest disruptive element of jewelry retailing in decades, says Jim Tuttle of Green Lake Jewelry Works. “Although it has always been done, and it used to be the only way to get jewelry 100-plus years ago, the return to custom jewelry as the standard, and the desire to connect with something more than an expensive bauble that any other reasonably well-off person could also own, has changed many industries, jewelry for sure. I believe it has to do with an innate desire to have a story to tell about one’s life. Jewelry is one of the most personal items we own, and the only thing most people will wear every day for the rest of their lives.

“We also know that no matter how expensive, a gift can be quite thoughtless, but a custom-made gift, like a wedding ring, push present, anniversary or graduation memento, requires much thought about the wearer and therefore imparts far more meaning than even a more expensive ‘off the rack’ item.”

As meaningful as custom jewelry is to consumers, it also pays well for retailers. “While the margins on loose diamonds may not be what your parents were used to, custom margins are easily keystone or better with no inventory required.

Better margins and awesome turn. What could be better?” says David Geller.

Moreover, custom jewelry by definition cannot be price-shopped. “Most custom customers are not looking for a ‘deal,’” says Fruchtman. “They are driven by the design.”

Rosenheim says that Tiny Jewel Box took the custom concept and used it to design a bridal collection several years ago that is now its best-selling line. “We began by using classic silhouettes with period details. It became immediately successful and has grown to the point that it completely dominates our bridal business,” says Rosenheim. “We own all the CAD designs, so it’s all customizable. We can alter molds. It’s turned into a monster.”

He goes on to say that, even outside of the bridal collection, most customers want to customize even the most basic designs. “You could see four or five variations in the showcase, but they want to put their own spin on it. It’s not like people want anything esoteric; they just want that feeling of being involved, having a hand in it and reflecting their own personal style.”

Advertisement

DIGITAL

CLIENTELING

TOOLS

One of the core questions of being a jewelry retailer has always been: How do I get my clients to come back? In the early days of INSTORE, we ran many articles about how to convince engagement ring buyers to return and buy more jewelry over the course of their lives.

Today, thanks to technology like video conferencing, website chat, review platforms and even simple phone texting, reconnecting with clients is astoundingly easy.

And jewelry buyers want that, says consultant Kathleen Cutler. “As online sales became ubiquitous, customers have been faced with an overwhelming amount of noise disguised as ‘choice’ and are in desperate need of guidance from a trusted advisor. The past 10 years have shown an absolute requirement for old-school clienteling practices,” she says. “What is old is new, and the ability to focus on creating sophisticated customer experiences will set apart the next generation of showrooms, both physically and virtually.”

Part of that experience will be making the selection and purchase process ever simpler, says Fetanat. “This shift has brought not only another way to book appointments with clients but accommodate people wherever they are. Furthermore, offering a chat feature on websites allows instant dialogue and is more likely to turn a website visitor into a purchasing customer.”

Dupuy says that the COVID-19 pandemic accelerated the use of such technology, both by retailers and by consumers. “The one-to-one communication provides electronic intimacy and is a tremendous time-save for the consumer, even if just for ‘pre-shopping’ and not actual purchase. This channel will become more important as customization continues its growth trajectory. Smart jewelers can engage the consumer at all steps of a customized piece of jewelry, providing a sense of ownership of design in the experience.”